“Solar cells will be the new promising commodity in the future, just like oil now,” said Fabby Tumiwa during his explanation in the REinvest Indonesia – China forum.

The forum aims to bridge the two countries in renewables investment collaboration. Indonesia is actively seeking a way to provide cleaner, cheaper, and more reliable energy sources in order to revitalize its current energy system that heavily relies on fossils. Meanwhile, China faces global force as well to reduce its carbon emission due, and pledge to be carbon neutral by 2060. As the two countries have things in common to reduce carbon emission, dialogue to bridge the needs is set-up.

Fabby Tumiwa, in his capacity as the chairman of Indonesia Solar Association and Executive Director of IESR, said that Indonesia needs to accelerate the renewables deployment to seize the target of RUEN i.e 23% renewables in national energy mix and further to be zero emission in 2050. Even though the government of Indonesia set the target to be net zero emission in 2070.

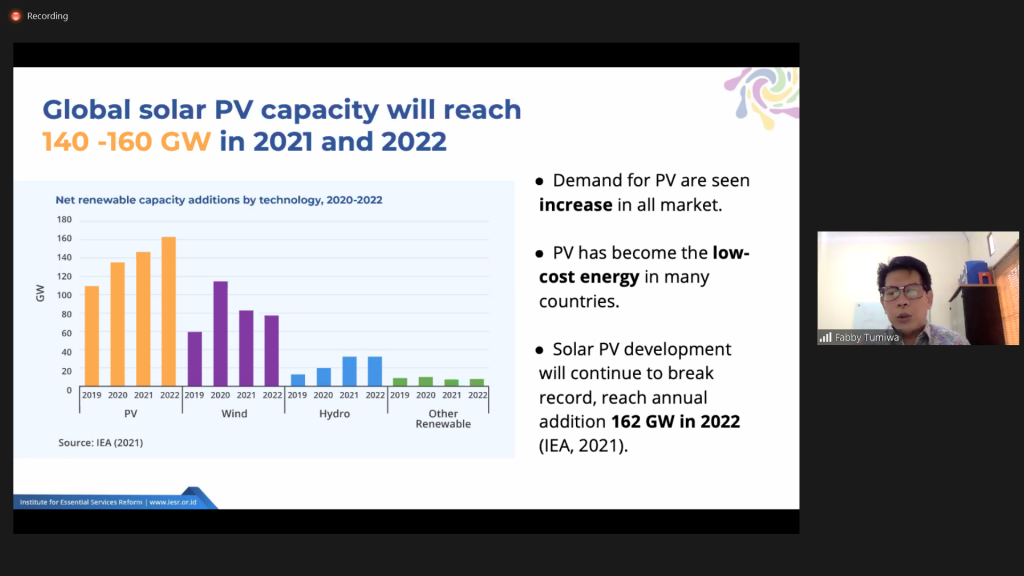

Solar PV can be the prime mover and key to achieving the decarbonization target. This is in line with the global urgency to have deep decarbonization. Mentioned by IEA in the latest report that solar and wind will dominate the energy system in the future up to 78% of power generation in 2050, in which solar should increase from 160 GW now to 650 GW in 2030. On the same occasion, IEA emphasizes the urgency to scale up renewables in this decade to achieve zero-emission in 2050. In terms of a strategic point of view, solar is a bit more privileged as it is able to be installed modularly. In the future solar energy is a popular commodity just like oil in the present day.

However, the promising future is not coming without any flaws. There are a bunch of situations that hold back the acceleration of the solar PV industry in Indonesia.

PLN’s oversupply condition is one of the most significant barriers to solar deployment. The situation makes it hard for both the government and private sector to penetrate renewables into the electricity system.

Meanwhile, Eka Satria, CEO Medco Power Indonesia, highlighted some points including the preference of the government and Indonesian market to choose short-term low-cost energy sources, the uncertainty of policy and regulation, BPP vs local content requirements, and also land acquisition issue.

As the chairman of the Indonesian Solar Panel Producers Association (APAMSI) Linus Sijabat shares things that should be prepared by the foreign investor in this occasion China, before penetrating the Indonesian market. Supply chain management, especially related to the local content requirement becomes his key point.

“Foreign and domestic cooperation is required for products of more than 60% whose prices are competitive, the quality is internationally certified, and the market is sustainable,”

The willingness of the government must be shown in the regulation such as RUPTL (general planning of electricity compliance) so private investors will be able to see the potential market for renewables in Indonesia. Moreover, in Indonesia PLN stands as the single buyer for electricity. Besides the chance that should be visible in the planning document, another enabling environment for renewables investment must be ensured as well.